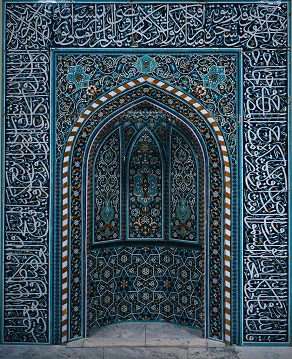

Typically Shariah compliance / Islamic law in banking focuses on the prohibition of interest (usury), however in payments there are a number of other factors to consider including merchants of prohibited activities as well as apportionment of risk.

Typically Shariah compliance / Islamic law in banking focuses on the prohibition of interest (usury), however in payments there are a number of other factors to consider including merchants of prohibited activities as well as apportionment of risk.

The basic sources of Shariah are the Qur’an and the Sunna, which are followed by the consensus of the jurists and interpreters of Islamic law. The central feature of the Islamic finance system is the prohibition in the Qur’an of the payment and receipt of interest (or riba). The strong disapproval of interest by Islam and the vital role of interest in modern commercial banking systems led Muslim thinkers to explore ways and means by which commercial banking could be organized on an interest-free basis (an overview is appended to this application).

Islamic Banking is growing at a rate of 10-15% per year and with signs of consistent future growth as the estimated 1.97bn Muslims worldwide seek halal banking and payment solutions. Standard & Poors estimate that Islamic banking assets in the Gulf Cooperation Council (GCC) reached $285 billion at year-end 2008, amounting to a market share of 22% of total banking assets, compared with less than 10% in 2003. This growth is forecast to continue.

Islamic banks have more than 300 institutions spread over 51 countries, including the United States through companies such as the Michigan-based University Bank, as well as an additional 250 mutual funds that comply with Islamic principles. Assets of the top 500 Islamic banks expanded 28.6% to total $822 billion in 2009, compared with $639 billion in 2008, according to Standard & Poors. This represents approximately 0.5% of total world estimated assets as of 2005. According to CIMB Group Holdings, Islamic finance is the fastest-growing segment of the global financial system and sales of Islamic bonds rose by estimated 24 percent to $25 billion in 2010.

At Flo2Cash, we believe the development and certification of such an end to end process and payment systems under Shariah compliance will be a significant breakthrough and be welcomed by banks as a differentiation strategy, underlying card holders and merchants in Islamic countries and anywhere Islamic banking is offered in Western countries also.